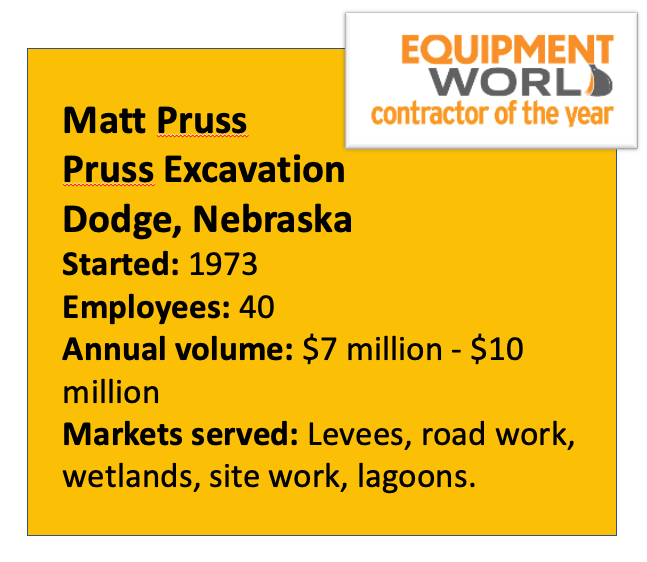

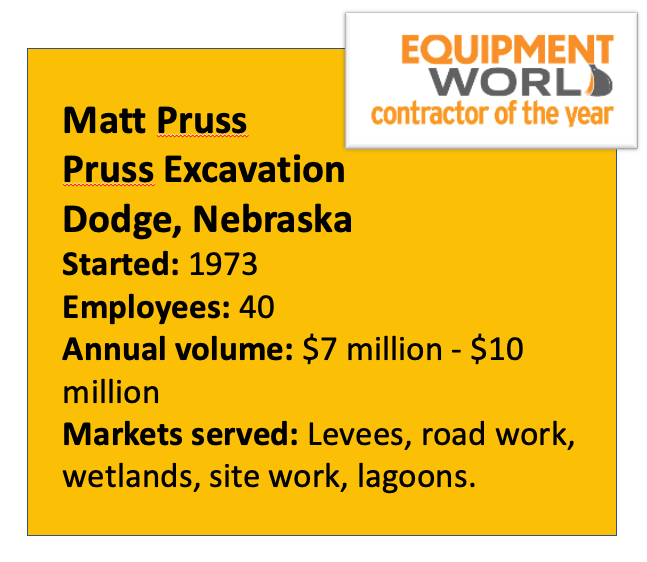

The construction lineage is deep in the Pruss family. Matt’s grandfather, Jim Sr., started Pruss Excavation in 1968. His father, also named Jim, joined him four years later, and Matt came on board in 2001.

But Matt’s start in construction goes much further back than 2001.

“I got on an excavator when I was 10 years old. When my dad told me to dig, I just kept on digging,” he says with a laugh. “Mom freaked out, but I enjoyed it.” And as he was growing up, both he and brother Scott, who now serves as superintendent with Pruss Excavation, pitched in when his father found himself shorthanded.

“I got on an excavator when I was 10 years old. When my dad told me to dig, I just kept on digging,” he says with a laugh. “Mom freaked out, but I enjoyed it.” And as he was growing up, both he and brother Scott, who now serves as superintendent with Pruss Excavation, pitched in when his father found himself shorthanded.

Matt went on to get a construction management degree, something he didn’t know was available until Freshman Day at the University of Nebraska. He had planned to go into business, but after the dean of the university’s construction management college learned his dad was a contractor, he convinced Matt to switch majors.

“We had some amazing professors who gave us real-world scenarios,” Matt says.

One example: it’s bid day and the students are estimating a project. The professor would go through the students with a handful of papers with vendor and sub quotes. “He would literally just throw them your way,” Matt recalls. “Some quotes didn’t have bonding and some didn’t include taxes, and you had figure out the good ones to develop the bid.”

Matt thought the exercise was exaggerated until he got back into the family business right after college. “It was not,” he says.

When Matt came on board, his father’s first instinct was to put him behind the controls of a machine, because he knew exactly how much operator/machine hours translated to the bottom line.

Matt had other ideas, though. Working in what then were company offices – in the basement of his parents’ home – he started estimating and soon bidding jobs that were outside of the company’s typical work of building terraces for area farmers.

“I know Pruss Excavation grew because of my education,” he now says. “We could get into the commercial side and chase bigger work.”

So the company began to expand, eventually moving from the basement office to a separate structure on the family farm in Dodge, Nebraska, one and a half hours northwest of Omaha.

Now Pruss Excavation logs $7 million to $10 million in annual revenues, has around 40 employees and does a variety of work, including dams and levees, roadwork grading, wetlands, landfill cell construction, site work and lagoons.

The transition from father to son was gradual as Matt took on bidding, contract management and submittals. And his brother Scott Pruss now manages several in-field duties, including serving as the firm’s quality control manager.

A turning point was a $3.4 million dam project in 2008; the company came in low by $13,000.

“It was a great job for us,” Matt recalls. Started right before the economy soured in the Great Recession, it also helped the company weather that economic storm.

Floodwaters

Pruss Excavation was to weather more storms, this time the meteorological variety. Major floods hit Nebraska in 2011 and 2019, and both changed the makeup of the company’s equipment fleet.

During the 2011 flood, Cat dealer NMC called and asked Matt if he still had the Challenger tractors with pull-behind scrapers. The company had eight at the time.

NMC was renting haul trucks to the U.S. Army Corps of Engineers on levee repair work after the flood, and the Corps decided the trucks weren’t the right equipment for the job. It was spending too much time building roads for the trucks and not enough time hauling dirt.

Pruss soon had six Challengers with pull-behind scrapers on the job and then bought five more from a dealer in Florida. Even that wasn’t enough, and it had to rent additional machines.

“By the time that project was done, we had 70 machines running, including 23 pull-behinds along with support equipment,” Matt says. “That was our huge, giant boost. Before, we were doing around $3 million a year, and with that project, we hit more than $8 million.”

It didn’t hurt that the job had a $43-an-hour federal wage. “I had guys from all over the country wanting to work for us,” Matt says. “Finding labor was not an issue.”

Of course, high demand comes with its own challenges. Pruss’s competition was doing the same thing, and everyone was scrambling for equipment and parts.

The 2011 and 2019 Nebraska floods helped Pruss Excavation up its equipment fleet and project management skills.Pruss ExcavationThe 2019 flood also had an equipment fleet impact, with Pruss buying six dozers to handle the flood mitigation work. “We were going in with 40 additional people, so I was buying things up like crazy,” he says. “We had nine dozers on that site running every day.” The job also racked up machine hours. “At one time we were working 12-hour days seven days a week. My operators were making amazing money.”

The 2011 and 2019 Nebraska floods helped Pruss Excavation up its equipment fleet and project management skills.Pruss ExcavationThe 2019 flood also had an equipment fleet impact, with Pruss buying six dozers to handle the flood mitigation work. “We were going in with 40 additional people, so I was buying things up like crazy,” he says. “We had nine dozers on that site running every day.” The job also racked up machine hours. “At one time we were working 12-hour days seven days a week. My operators were making amazing money.”

Pruss also put two mechanics on the 18-month job. “I knew stuff was going to fail and what we had to do to fix it,” he says.

In assessing the levee repairs done on the project, a reviewer with the U.S. Army Corps of Engineers ranked Pruss’s quality and scheduling as “exceptional.” The review said: “Not only was the levee repair a phenomenal effort and of exceptional quality, but the Pruss Excavation team even went out of their way to ensure that all work areas were clean and properly grade.”

The Corps took special note of how the two Pruss brothers worked together: “Matt and Scott’s combined teamwork really and truly enabled the success of this project…[they] were always synchronized in all efforts and activities and any absence by one was seamless with no disruption in performance.”

Regarding cost control, the Corps assessment added: “It was a skillful performance, and Matt’s pricing and responsiveness rivals that of much larger organizations observed over the past two years performing similar work. The best aspect of working with them is that they always construct a great product.”

Of course, the all-of-the-sudden levee repair work had to be managed with prior commitments.

“They had a very challenging project with us, and they continued to push through on our job and honor their obligations even while they were doing the levee work,” says Luke Ridder with Hawkins Construction.

Pruss Excavation jobsite huddle.“A lot of contractors would just chase the flood work,” he adds, “but Matt stuck around, and he kept the job moving. It was a big deal. Matt knows he can’t just be an owner and pick up a paycheck. He’s very involved and he drives the ship on their modeling.”

Pruss Excavation jobsite huddle.“A lot of contractors would just chase the flood work,” he adds, “but Matt stuck around, and he kept the job moving. It was a big deal. Matt knows he can’t just be an owner and pick up a paycheck. He’s very involved and he drives the ship on their modeling.”

This flood remediation experience came into play when the company bid on an emergency $1.05 million contract with a 144-hour turnaround. The job required over 33,500 tons of materials to be imported to close a breach that was 350 feet long and over 25 fee deep with flood water still flowing through it. “We had a pre-bid meeting at 1 p.m., they wanted bids at 4 p.m. and would sign the contract at 4:05 p.m.,” Matt says. “We were low by $11,800 and got it done early.” The project required a dozen operators and 30 trucks.

“A week later we were low bid on another fast-track levee repair,” Matt says. “We were low by $55,000 on a $2.8 million contract with a 168- hour completion. We successfully completed that repair on-time as well.”

Matching fleet to job demand The company’s fleet of pull-behind scrapers — now at 32 — has helped them tackle wet conditions.

The company’s fleet of pull-behind scrapers — now at 32 — has helped them tackle wet conditions.

“We have had more machines than people throughout the years, and we’re still that way,” Matt says. This also allows Pruss Excavation to stage an upcoming jobsite while finishing another and thus lessen time spent on mobilization.

Its fleet of pull-behind scrapers now numbers 32. “Pull-types are awesome in the wet and the sand,” Matt says, noting that the company also uses Cat 627 self-propelled scrapers in drier conditions.

Although the bulk of his fleet is in the large machine category – including dozers, excavators, articulated trucks, scrapers and scraper tractors – Matt also uses skid steers as support machines. “We’re also heavy into Topcon GPS,” he says, “and in addition to dozers, scrapers, and motor graders, we also put the excavators on grade control. We’ve found it very user friendly.”

While operators are responsible for daily greasing, Pruss uses NMC to handle PM tasks. “They’ll service my entire fleet, no matter the brand,” he says. Engine, transmission and other major repairs go to dealers.

Today’s machine telematics also help with service, he says. “When we get a warning, dealers can diagnose and know where the machine is and what they need to fix it.”

But he’s also learned these convenient diagnostics can eat up tech time if an easy fix is not readily apparent. “I always press my dealers for warranties that cover diagnostics,” Matt says. “I don’t want to be billed for the time it takes them to figure out a problem.”

Legacy Father Jim Pruss (left) and brother Scott Pruss (right) flank Matt Pruss at the Contractor of the Year event.

Father Jim Pruss (left) and brother Scott Pruss (right) flank Matt Pruss at the Contractor of the Year event.

Being named the 2021 Contractor of the Year has special resonance for Matt: His father, Jim Pruss Jr., was named a Contractor of the Year finalist in 2004. Both his father and brother attended the Contractor of the Year event last month and witnessed his win.

Neither is surprised he came away with the award. Matt’s clients and vendors also notice his attention to detail in how he approaches his jobs.

“He’s a heck of a businessman,” says his dealer representative Kevin Peterson with NMC. “And you can see it in the way he’s grown.”

“They know the type of leadership it takes to run a great small business,” says Ridder. “They just get it done.”

“We let our work to speak for us,” Matt says. “We want to under-promise and over perform instead of the other way around.”

Watch Matt Pruss receive the Contractor of the Year award below:

Business5 years ago

Business5 years ago

Business3 years ago

Business3 years ago

Tech3 years ago

Tech3 years ago

Tech2 years ago

Tech2 years ago